by Richard Keyt, LLC Attorney

If you hired KEYTLaw, LLC, to obtain a federal employer ID number (an EIN) from the IRS for an Arizona LLC or corporation then a responsible party of the company must sign and deliver to us an IRS form IRS Form SS-4. The responsible party’s signature on the SS-4 form authorizes our legal assistant to contact the IRS and get the EIN.

There are two ways you can get an EIN:

1. Have a responsible party complete and and digitally sign our DocuSign IRS Form SS-4 by clicking on the appropriate SS-4 link below. This process will send the signed SS-4 form to the responsible party and to us.

2. Us the IRS’ do-it-yourself online EIN wizard to get the EIN in five minutes. This method can be quicker than filling out the IRS Form SS-4.

How To Apply for an EIN

You can apply for an EIN online or we can do it online if you purchased a Silver or Gold LLC package or a Bronze LLC package and paid an additional fee for EIN service, but you must be in the U.S. or a U.S. possession. Applicants who are outside of the U.S. or U.S. possessions must apply by phone, by fax, or by mail. Use only one method for each entity so you don’t receive more than one EIN for an entity.

If you have a legal residence, principal place of business, or principal office or agency in the U.S. or U.S. possessions, you can receive an EIN online and use it immediately to file a return or make a payment. To use the IRS’ online EIN application the principal officer, general partner, grantor, owner, trustor, etc., must have a valid U.S. taxpayer identification number (SSN, EIN, or ITIN).

If you have NO legal residence, principal place of business, or principal office or agency in the U.S. or U.S. possessions, you can’t use the online application to obtain an EIN. If you cannot use the IRS online EIN wizard then see the right column on page 1 of the instructions for IRS form SS-4 to learn how to apply by telephone, fax or email.

Who Is a Responsible Party?

A responsible party is a person whose name goes in SS-4 box 7a and who is one of the following:

- a member or manager of the LLC

- a trustee of a Confidential Trust or a revocable living trust

- the owner of an IRA account who is also a manager of the LLC

- an officer or director of a corporation.

The article below explains how to answer the various questions on the SS-4 form.

For People Who Hired Us to Get an EIN: How to Complete & Sign IRS Form SS-4

We cannot obtain the EIN until a “responsible party” associated with the company clicks on the appropriate link below and completes the IRS Form SS-4 using our DocuSign power form. When the responsible party completes the DocuSign SS-4 form DocuSign will send the completed and signed SS-4 to us and to the email address the responsible party entered into the DocuSign system.

- SS-4 for an LLC that has one member/owner or two members/owners who are married to each other and who own the LLC as community property: Click on the following link to access and complete our online DocuSign SS-4 for an LLC taxed as a sole proprietorship.

- SS-4 for an LLC that has two or more members/owners who are not are married to each other and the LLC will not be taxed as an S corporation or a C corporation: Click on the following link to access and complete our online DocuSign SS-4 for an LLC taxed as a partnership.

- SS-4 for an LLC that will be taxed as an S corporation: Click on the following link to access and complete our online DocuSign SS-4 for an LLC taxed as an S corporation.

- SS-4 for a non-profit corporation: Click on the following link to access and complete our online DocuSign SS-4 for a non-profit corporation.

If you click on one of the above links to complete and send us the SS-4 using DocuSign be sure to review the text below with graphics that explains how to complete the SS-4.

If you have any questions call KEYTLaw legal assistant Michelle Watkins at 480-664-7413 or send an email to her at [email protected].

Do It Yourself Using the IRS Online Wizard

It is actually easier to complete the IRS’ online wizard and get your EIN in 5 – 10 minutes than it is to complete, print, sign and scan and email or fax the signed SS-4 form to us. If you want to get your EIN yourself using the IRS’ wizard watch this demonstration video and go to the IRS’ EIN wizard. The IRS wizard asks for the same information on the SS-4 form.

- Click on the Apply Online Now button to start the wizard.

- Next click on Begin Application.

- On the next page select the Limited Liability Company LLC if your company is an LLC or Corporation if your company is a corporation.

The end result of completing the online wizard will be the IRS’ website will display the company’s EIN. Be sure to write down the EIN or print the page that has the EIN and keep it in a safe place.

How to Complete IRS Form SS-4

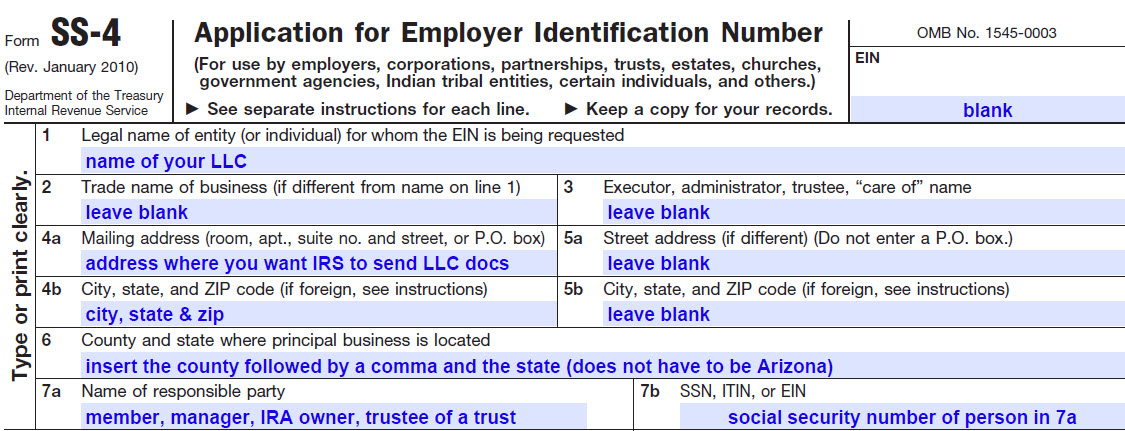

Most of the questions asked in the SS-4 are self-explanatory. Some questions, however, are not obvious. This article explains what to insert in boxes that are not self-explanatory. Note: Where you see the text “leave blank” you must not enter any text in those boxes.

The first six questions are easy.

- Box 7a: Insert the full name (first name, middle name & last name) of the responsible person who will sign the SS-4. The responsible person must be affiliated with the LLC in one of the following ways: (1) a member, (2) a manager, (3) IRA owner if the LLC is an IRA LLC, or (4) the trustee or trustmaker of a trust that is a member of the LLC. If the LLC is owned by an entity you can enter the name of the entity in Box 7a.

- Box 7b: Insert the social security number of the person whose name is in Box 7a or the EIN of the entity named in Box 7b.

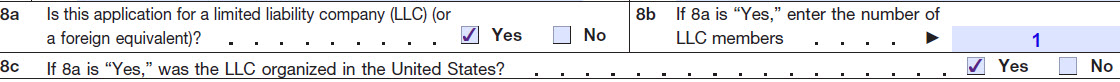

- Box 8b: Enter the number of members of the LLC. The general rule is that if both spouses of a married couple own a joint interest in the LLC they are two members for the purposes of Box 8b. However, if both spouses of a married couple own their interest in the LLC as community property they have an option to be treated as one member so that the LLC can be taxed as a sole proprietorship. If you and your spouse own your interest in your LLC as community property and the two of you are the only members I recommend that you insert the number 1 in Box 8b.

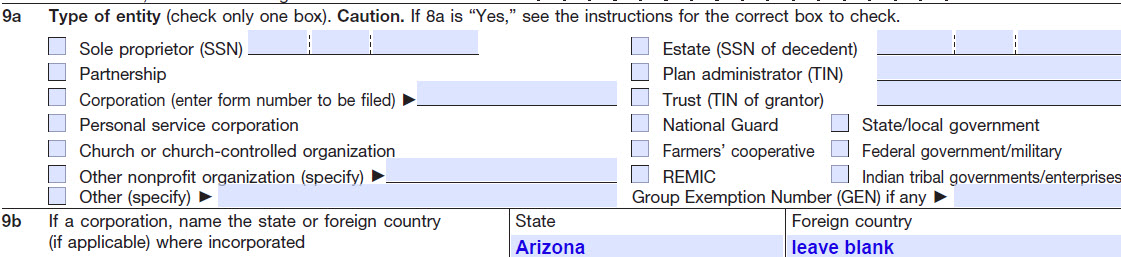

- Box 9a – Partnership: Check the Partnership Box if the LLC has two or more members and does not intend at this time to be taxed as a corporation or an S corporation. Do not check any other boxes or enter text any where else in Box 9a.

- Box 9a – C or S Corporation: Check the Corporation box regardless of the number of members of the LLC if you know at this time that the LLC should be taxed under Subchapter C (C corporation) or Subchapter S (S corporation) of the Internal Revenue Code. If you check this box then insert the IRS tax return form number (1120 for C corporations or 1120S for S corporations) to the right of the check. If you are not sure whether your LLC should be taxed as a C or S corporation do not check the Corporation box. Instead check the: (1) Partnership box if your LLC has two or more members who are not married to each other and or are married but do not own their interest in the LLC as community property, or (2) the Other box if your LLC has one member or has only two members who are a married couple who own their interest in the LLC as community property. Do not check any other boxes or enter text any where else in Box 9a.

- Box 9a – Other: Check the Other box and insert “disregarded entity – sole proprietorship” to the right of the triangle if your LLC has one member or two members who are married and own their interest in the LLC as community property. Caution: If you know that you want your LLC to be taxed as a C or an S corporation do not check the Other box or insert the text. Instead, follow the instructions in the preceding paragraphs. Do not check any other boxes or enter text any where else in Box 9a.

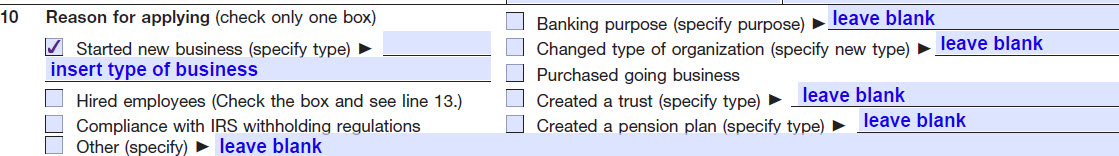

- Box 10: Check the Started new business (specify type) box. Insert text that describes your type of business.

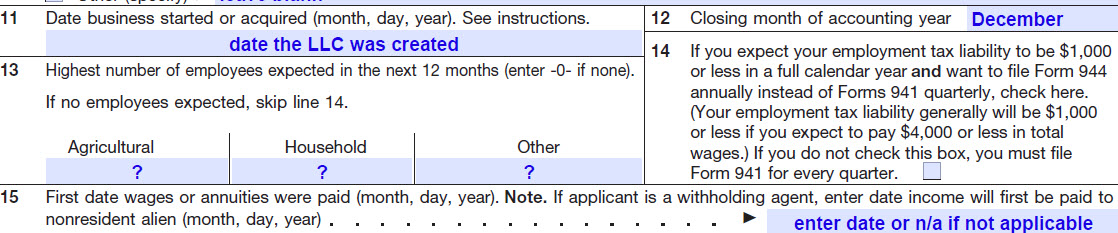

- Box 11: Enter the month, day and year when the LLC’s Articles of Organization were filed with the Arizona Corporation Commission. The date is on the Articles of Organization we emailed to you when we formed your LLC. You may also go to the ACC’s website to look up your LLC’s formation date.

- Box 12: Enter the last month of your LLC’s accounting or tax year. Most LLC’s insert December in this box.

- Box 13: Enter the highest number of employees the LLC will have in its first 12 months or enter -0- if applicable. If the LLC will not have any employees leave blank and skip to Box 14.

- Box 14: If you expect your employment tax liability to be $1,000 or less in a full calendar year, you are eligible to file Form 944 annually (once each year) instead of filing Form 941 quarterly (every three months). Your employment tax liability generally will be $1,000 or less if you expect to pay $4,000 or less in total wages subject to social security and Medicare taxes and federal income tax withholding. If you qualify and want to file Form 944 instead of Forms 941, check the box on line 14. If you do not check the box, then you must file Form 941 for every quarter.

- Box 15: If the business has employees business has employees, enter the date on which the business began to pay wages or annuities. For foreign applicants, this is the date you began to pay wages in the United States. If the business does not plan to have employees, enter “N/A.”

- Box 16: Check the one box on line 16 that best describes the principal activity of the applicant’s business. Check the “Other” box (and specify the applicant’s principal activity) if none of the listed boxes applies. You must check a box.

Construction. Check this box if the applicant is engaged in erecting buildings or engineering projects (for example, streets, highways, bridges, tunnels). The term “Construction” also includes special trade contractors (for example, plumbing HVAC, electrical, carpentry, concrete, excavation, etc. (contractors).

Real estate. Check this box if the applicant is engaged in renting or leasing real estate to others; managing, selling, buying, or renting real estate for others; or providing related real estate services (for example, appraisal services). Also check this box for mortgage real estate investment trusts (REITs).

Rental and leasing. Check this box if the applicant is engaged in providing tangible goods such as autos, computers consumer goods, or industrial machinery and equipment to customers in return for a periodic rental or lease payment.

Manufacturing. Check this box if the applicant is engaged in the mechanical, physical, or chemical transformation of materials, substances, or components into new products. The assembling of component parts of manufactured products is also considered to be manufacturing.

Transportation & warehousing. Check this box if the applicant provides transportation of passengers or cargo; warehousing or storage of goods; scenic or sight-seeing transportation; or support activities related to transportation.

Finance & insurance. Check this box if the applicant is engaged in transactions involving the creation, liquidation, or change of ownership of financial assets and/or facilitating such financial transactions; underwriting annuities/insurance policies; facilitating such underwriting by selling insurance policies; or by providing other insurance or employee-benefit related services.

Health care & social assistance. Check this box if the applicant is engaged in providing physical, medical, or psychiatric care or providing social assistance activities such as youth centers, adoption agencies, individual/family services temporary shelters, daycare, etc.

Accommodation & food services. Check this box if the LLC is engaged in providing customers with lodging, meal preparation, snacks, or beverages for immediate consumption.

Wholesale – agent/broker. Check this box if the applicant is engaged in arranging for the purchase or sale of goods owned by others or purchasing goods on a commission basis for goods traded in the wholesale market, usually between businesses.

Wholesale – other. Check this box if the applicant is engaged in selling goods in the wholesale market generally to other businesses for resale on their own account, goods used in production, or capital or durable non-consumer goods.

Retail. Check this box if the applicant is engaged in selling merchandise to the general public from a fixed store; by direct, mail-order, or electronic sales; or by using vending machines.

Other. Check this box if the applicant is engaged in an activity not described above. Describe the LLC’s principal business activity in the space provided.

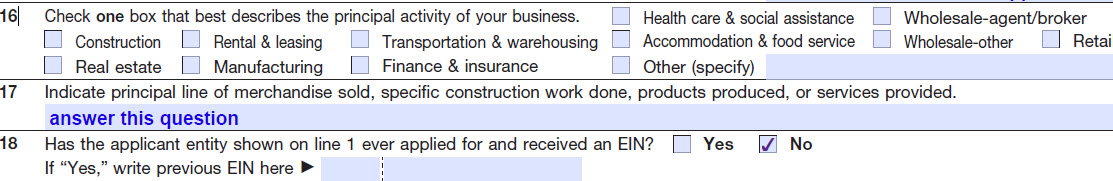

- Box 17: Use box 17 to describe the LLC’s principal line of business in more detail. For example, if you checked “Construction” in box 16, enter additional detail such as “General contractor for residential buildings” in box 17. An entry is required.

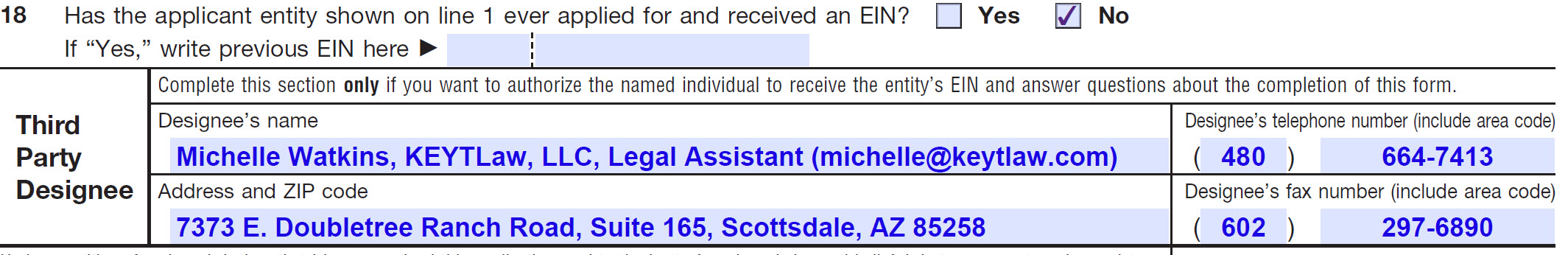

- Box 18: Check no in box 18.

- Third Party Designee. If you want us to obtain the employer id number (EIN) for your LLC, you must enter all of the information show below.

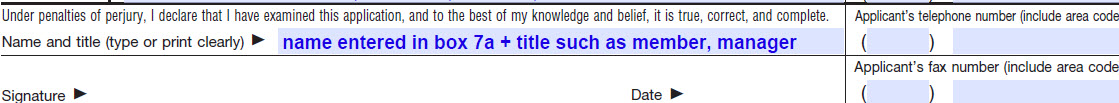

- Signature & Date Signed. Enter the name you entered in box 7a followed by the title that applies to that name. Examples of titles are: member, manager, trustee, trustor (aka trustmaker), President (if the name is a corporation) and Partner (if the name is a partnership). Enter the phone and fax number of the signer. The person named in box 7a must sign on the signature line and enter the date the SS-4 is signed.

Leave A Comment

You must be logged in to post a comment.