Section 10.1 Fundamental Rules of Asset Protection

Asset Protection Rule Number 1: Purchase and maintain as much insurance as you need and can afford to insure your company’s activities and assets. Your company needs to be adequately insured for whatever it is doing and for the assets it owns. The types of insurance coverage and coverage amounts depend on several factors such as the nature and extent of the company’s activities and the types and values of its assets. You should consult with an experienced insurance agent as to the insurance needs of the company. Make sure you have written proof of insurance showing that the LLC is a named insured. If you transfer real property to your LLC, but do not obtain insurance naming the LLC as an insured, the insurance company will probably deny coverage.

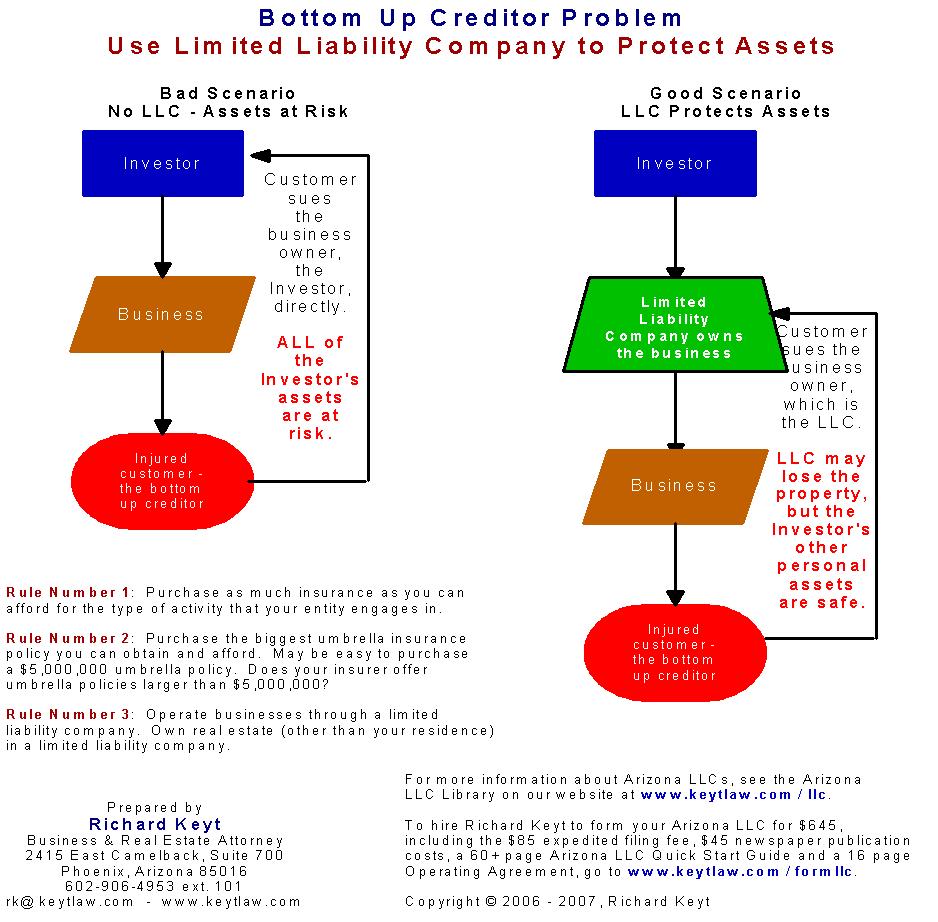

Asset Protection Rule Number 2: Operate a business or hold title to investment real estate through a limited liability company. Most real estate investors know that the reason to form an LLC and to transfer investment real estate to the LLC is to reduce or eliminate the risk that the investor may lose his or her life savings because of a disaster with the property. If the water heater blows up at the rental property and you hold title in your name, you may be sued and a judgment that exceeds your insurance coverage could take your life savings. If your LLC owns the property, it will be the defendant in the lawsuit and you should not be liable personally unless you were the reason the water heater blew up. The same concepts apply to a business. Operate the business through an LLC so that the LLC, as owner of the business, will be sued if something goes wrong.

Asset Protection Rule Number 3: Diversify your assets. The old adage “do not put all of your eggs in one basket” applies to owning businesses and real estate investment just like it does to any type of investment. If you satisfy Asset Protection Rule Number 2 and create a single LLC to hold title to your three investment properties and a disaster occurs on one of the properties, the creditor could reach all of the equity in all the assets owned by that limited liability company, i.e., all three properties.

Do Not Be Pennywise & Pound Foolish. If you buy three properties today for no money down, you will not lose much if you lose all three properties in the near future (but you might in the future when the properties appreciate in value). However, if you have $50,000 of equity in each property, you risk losing $100,000 that could easily be protected by having a separate LLC own each property. By saving the relatively small amount I charge to form additional LLCs you risk losing all of your equity in each property held by the same LLC. The more properties your single LLC owns, the greater the risk that there could be a problem with one of the properties that could result in a lawsuit.

Consider the onetime cost to form and operate an additional LLC as an alternate form of insurance that you should not go without. The cost to form an LLC is peanuts compared to the amount you may invest in a business or property.

Section 10.2 General Rule: Members and Managers of an Arizona LLC are Not Liable for Debts of the Company

Arizona Revised Statutes Section 29-651 contains the general rule with respect to the nonliability of members and managers of an Arizona limited liability company. It states:

“Except as provided in this chapter, a member, manager, employee, officer or agent of a limited liability company is not liable, solely by reason of being a member, manager, employee, officer or agent, for the debts, obligations and liabilities of the limited liability company whether arising in contract or tort, under a judgment, decree or order of a court or otherwise.”

Limiting the liability of members and managers of the LLC is the primary reason people form limited liability companies.

Your company will not provide any asset protection with respect to activities not conducted by the company or assets not owned by the company. For example, if you formed the company to own a residence and rent it to a tenant, the LLC does not protect you from things that can go wrong with the property if the LLC does not hold title to the property. Nor will the company protect you from breach of contract claims arising from a contract that you sign personally instead of the company.

The general rule of no liability for members only applies to protect a member if the member has NO INVOLVEMENT with the company other than as a mere member. We all know that if you own ten shares of GM stock and that is your only connection to GM, you will not be named as a defendant when GM is sued. Members of Arizona limited liability companies enjoy the same general rule protection from liabilities of the company as stockholders of Arizona corporations.

The key to protection from the liabilities of the company is that the member must not have any involvement with the company other than as a mere member/owner. To the extent the member of an Arizona limited liability company is also involved with the company as a manager, employee or agent, the member will lose the protection from liability afforded by the general rule of no liability stated in Arizona Revised Statutes Section 29-651. Members of an Arizona limited liability company who also act as managers, employees or agents of the company will be liable for their own acts and omissions.

The following is a graphical illustration of the general rule of how an Arizona limited liability company can protect its members from liability arising from the company’s business activities.

Section 10.3 When an LLC Does Not Protect Members and Managers from the Company’s Liabilities

There is one huge exception to the general rule that members and managers are not liable for the debts and obligations of the company. Because it is so important to understand when the limited liability company does not protect members, managers, employees and agents, I am highlighting the exception below:

IF YOUR ACT OR OMISSION CAUSES HARM, YOU MAY BE SUED AND YOU MAY BE LIABLE EVEN THOUGH YOU ARE ACTING AS A MEMBER, MANAGER OR EMPLOYEE OF THE COMPANY.

Another way a member can become liable for the liabilities of the company arises when the member purports to act on behalf of the company when the member does not have the authority to do so. Arizona Revised Statutes Section 29-652 provides:

“All persons who assume to act as a limited liability company without authority to do so are jointly and severally liable for all debts and liabilities incurred by the persons so acting.”

Therefore, members, managers, employees and agents of the company should not act on behalf of the company when they are not authorized to do so.

Even if you are authorized to act on behalf of the company, your act or omission can obligate the company and also perhaps create personal liability for you if it harms a person or entity. The bartender who over-serves liquor to a customer may be liable if the customer causes a car accident driving away from the bar. A doctor who is negligent during surgery while employed by a hospital is liable to the patient. A manager of a company that operates a taxicab business is liable if the manager negligently hires a driver whose license was revoked for three DUIs if the driver drinks while driving a customer and causes an accident that kills or injures the customer. The member of a company that owns a rental home is liable if the member improperly installs a gas water heater that later blows up and kills or injures somebody. The real estate agent who is showing a client a property and runs a red light that causes an accident that kills or injures the client is liable.

In all of the examples mentioned in the preceding paragraph, there are two parties that are liable, i.e., the company and person who actually caused the harm. The lesson to be learned is that if your goal is to avoid liability arising from the activity of the company, you must reduce or, if possible, eliminate all involvement with the company beyond merely owning a membership interest in the company. For people who must be involved with the company’s activities, their best protection from liability is adequate insurance coverage in the highest affordable coverage amounts.

The following is a graphical illustration of when an Arizona limited liability company does not protect its members from liability arising from the company’s business and from their acts and omissions.

Section 10.4 The Importance of Complying with Arizona LLC Law

The primary reason for forming an LLC is to protect the members and managers of the company from liabilities that can arise from the company’s activities. Asset protection, however, is not automatic. For the members and managers to obtain this important shield against liability, the company must comply with certain requirements applicable to operating as an LLC. Every Arizona LLC must establish and consistently follow certain fundamental policies and procedures. All members and managers of your company should know of, understand and follow the requirements of operating as an LLC because the risk of noncompliance is the loss of the shield that protects the members from the company’s liabilities.

The LLC is a legal entity that has its own life and existence separate and distinct from its members, managers, and employees. It is imperative that the separate existence of the LLC from other people and entities be recognized and respected. The LLC must conduct all of its business and investment activities in its name to preserve its status as a legal entity. Always make it clear to third parties that they are dealing with a limited liability company, not a person.

Company business and company activity must be conducted by members and managers in their capacities as members or managers, not in their individual capacities. For example, members should sign contracts and insert “member” or “manager” after their names when they sign. All contracts that involve the company as a party must clearly state the exact name of the company and that it is a limited liability company. For example, when the company is first named as a party to the contract, the text of the contract should designate the company using the following format:

<name of llc>, LLC

for example: World Wide Widgets, LLC

The signature block (where the company signs the contract) for the company should follow the appropriate format shown in Section 5.9 How the Company Should Sign Contracts.

One reason people form 8.5 times as many LLCs as corporations in Arizona is because the Arizona LLC has to comply with fewer formalities than an Arizona corporation. Arizona corporations must comply with six corporate formalities that do not apply to Arizona LLCs. Arizona for profit corporations must satisfy each of the following six corporate requirements:

a. Hold annual meetings of shareholders,

b. Hold annual meetings of the board of directors,

c. Document the meetings of shareholders with minutes or resolutions,

d. Document the meetings of the board of directors with minutes or resolutions,

e. File an annual report with the Arizona Corporation Commission, and

f. Pay a $45 annual fee to the Arizona Corporation Commission.

None of those six corporate formalities apply to an Arizona LLC. Even though Arizona law does not require that the members or managers of an Arizona LLC hold annual meetings and document the meetings with minutes or resolutions, I recommend that every Arizona company do it. You want to show that you are treating your LLC like a business and one way to do that is to hold regular meetings and document all important decisions made by members and managers.

Section 10.5 Piercing the Corporate / Company Veil – the Ultimate Disaster

There is a legal concept called “piercing the corporate veil.” It is court created law that is used by courts to impose liability on the shareholders of a corporation for the corporation’s debts. The term loosely means that the shield (or the corporate veil) normally given to shareholders that protects them from the debts of the corporation will be removed (pierced) by a court so that the shield will not protect the shareholders from liability for the corporation’s debts.

Case law that created the piercing the corporate veil concept arose long before LLCs were invented, which is why you don’t often hear the term “piercing the company veil.” The concepts and legal reasoning behind piercing the corporate veil will apply to LLCs. Courts will not hesitate to “pierce the company” veil and hold the members and managers of LLCs liable for the debts of the company when necessary to prevent an injustice.

A court will pierce the company veil and hold the members and/or managers of the company liable for the debts of the company if the trier of fact (the jury in a jury trial or the judge in a trial without a jury) finds that the company was the “alter ego” of the member or manager. An alter ego situation exists where there is a unity of interest and ownership with the company and the member or manager that blurs the distinction between the company and the member or manager, and where the upholding of the separation between the two would produce an inequitable result or perpetrate a fraud. Stated another way, if the court finds that there is no difference between the member or manager on the one hand and the company on the other and that enforcing the protective shield between the company and the member or manager would produce an inequitable result or perpetrate a fraud, the company will be deemed to be the “alter ego” of the member or manager and the member or manager will be liable for the company’s debts.

Section 10.6 Factors that Increase the Risk that a Court May Pierce the Company Veil and Hold the Members Liable for the LLC’s Debts

The California Court of Appeals in the well known case of Associated Vendors, Inc. v. Oakland Meat Co., Inc. (1962) 210 Cal. App. 2d 825, 26 Cal. Rptr. 806, listed facts that should be analyzed in determining if an alter ego situation exists. This case has been cited favorably many times over the years by other courts. Below in this Section is a list of negative facts that could be the basis for a court finding that an alter ego situation exists and that the company veil should be pierced. The court’s opinion in Associated Vendors involved corporations and stockholders, but I have changed the list of factors to refer to LLCs, members and membership interests instead of corporations, stockholders and stock. I believe that a court that is asked to pierce the veil of an Arizona LLC will use the same analysis used by other courts in cases involving piercing the veil of corporations.

Every Arizona LLC should: (i) prevent any factor in the following list from occurring, and (ii) eliminate or correct as soon as possible a negative factor that does occur. Some of the factors on this list include my editorial comments following the word “Note.”

a. Commingling of and failure to segregate assets of the company and its members or managers. Note: This is cardinal rule number one for avoiding a court piercing the company veil! The company must keep its assets separate from the assets of its members and mangers and third parties. The company must open a bank account in its name and all of its revenue must flow through its bank account. Do not deposit company revenue in a bank account that belongs to a member or manger or a third party. Company revenue must be deposited first into the company’s bank account from which it may be disbursed for bona fide company purposes.

b. The unauthorized diversion of company funds or assets to other than company uses. Note: This is cardinal rule number two for avoiding a court piercing the company veil! The company may not use its assets to pay the expenses of or to benefit its members, mangers or third parties. If a member needs cash to pay a personal expense, the company may disburse funds to the member if the payment is properly reflected on the company’s books as compensation, a loan, a return of capital or another legitimate disbursement.

c. The treatment by an individual of the assets of the company as his own. Note: If the company buys a home in Flagstaff and the only occupant is the member who never pays rent, it smells like the company used its assets to buy a home for the member.

d. The failure to obtain authority to issue membership interests or to subscribe to or issue the same.

e. The holding out by an individual that he is personally liable for the debts of the company. Note: This is the issue discussed elsewhere in this Operations Manual where we state how important it is for members and managers to always indicate clearly in contracts and in dealing with the public that they are acting as a member or manager of an Arizona limited liability company.

f. The failure to maintain minutes or adequate company records, and the confusion of the records when multiple related entities are involved. Note: Minutes are not required by Arizona law so the lack of minutes may not be as important as it would be in the context of a corporation. However, I recommend that all Arizona LLCs have regular meetings of members and managers, that they vote on important company decisions and that the meetings be memorialized in minutes or resolutions because it is prudent to do so and a good business practice and because it can be used to convince a court that it should not pierce the company veil.

g. The identical equitable ownership in the two entities.

h. The identification of the equitable owners thereof with the domination and control of the two entities.

i. Identification of the directors and officers or the members and managers of the two entities in the responsible supervision and management.

j. The use of the same office or business location by multiple related entities or multiple entities that are owned by the same owners.

k. Multiple entities employ the same personnel.

l. The failure to adequately capitalize the company, the total absence of company assets, and under-capitalization. Note: This can be an important factor depending on the circumstances of the company’s activities. Adequate capitalization is a moving target that is determined after the fact by a court using hindsight.

m. The use of a company as a mere shell, instrumentality or conduit for a single venture or the business of an individual or another entity.

n. The concealment and misrepresentation of the identity of the responsible ownership, management and financial interest, or concealment of personal business activities. Note: Time and time again people tell me they formed or intend to form an LLC in states like Nevada or Delaware because unlike Arizona, an LLC formed in those states does not have to disclose the name(s) of the member(s). Many questionable people sell Nevada LLCs on the basis that you can hide your ownership of the Nevada entity and therefore prevent your creditors from learning about your ownership of the entity. Hiding your ownership of a company could be a factor used by a court to pierce the company veil and hold you liable for the company’s debts.

o. The disregard of legal formalities.

p. The failure to maintain arm’s length relationships among related entities.

q. The use of the entity to procure labor, services or merchandise for another person or entity.

r. The diversion of assets from a company by or to a member, manager or other person or entity, to the detriment of creditors, or the manipulation of assets and liabilities between entities so as to concentrate the assets in one and the liabilities in another.

s. Contracting with another with intent to avoid performance by using an entity as a shield against personal liability, or the use of a company as a subterfuge or illegal transactions.

t. The formation and use of a company to transfer to it the existing liability of another person or entity.

Section 10.7 Personal Guarantees

One of the most common scenarios that imposes liability on a member of an Arizona limited liability company arise when the member guarantees the debts or obligations of the company. For example, it is very common for a lender to require the members of the company to guaranty the repayment of the promissory note as a condition to making the loan to the company. Prudent landlords require the member of a company to guaranty the lease between the landlord and the company.

If a member of a company guarantees the debts or obligations of a company, the general rule of no liability provided by Arizona Revised Statutes Section 29-651 does not apply to the debts and obligations guaranteed by the member. A personal guaranty is a voluntary contract between the guarantor(s) and the beneficiary of the guaranty. As a member, you have a choice as to whether to sign or not sign a guaranty.

You should always try to avoid signing a personal guaranty because it creates personal liability for you. Whether a guaranty is required and the extent of the guaranty are always negotiable. It may be that the other party may refuse to loan money to the company or enter into a lease with the company unless one or more members signs a personal guaranty, but you should always try to convince the other side that the members will not guaranty the debt. A member can then decide whether or not to sign a guaranty if the other side insists.

If you must guaranty the debt or obligation of the company, try to negotiate a guaranty that limits your liability. For example, instead of a signing a guaranty that is not limited by time or that does not limit the amount of your liability, try to negotiate limits on the duration and amount of your liability as a guarantor. Perhaps you can convince the other side that your guaranty will expire after one or two years and/or the maximum liability is something less than 100% of the company’s debt.

Section 10.8 Liability for False Statements in the Articles of Organization

You probably are not aware that you may incur liability as a member or manager of an Arizona limited liability company as a result of incorrect information in your company’s Articles of Organization. Arizona law requires that an Arizona limited liability company maintain Articles of Organization on file with the ACC that contains correct information about the company.

Arizona Revised Statues Section 29-657 is an important, but little known statute that can cause a member or manager of an Arizona limited liability company to become liable for incorrect or out of date information in the company’s Articles of Organization on file with the ACC. This statute states:

“A. If any articles of organization . . . contain any false statement, a person, including a member of a limited liability company, who suffers loss by relying on the false statement may recover damages for the loss from the limited liability company and from:

1. Any person who executes the articles, or causes another to execute the articles on his behalf, and knew or reasonably should have known, and any responsible person who knew or reasonably should have known, the statement to be false at the time the articles were executed.

2. Any responsible person who knows or reasonably should have known that ANY arrangement or OTHER FACT DESCRIBED IN THE ARTICLES HAS CHANGED, MAKING THE STATEMENT INACCURATE IN ANY RESPECT within a sufficient time before the statement was relied upon reasonably to have enabled that responsible person to amend the articles.

B. For purposes of this section, ‘RESPONSIBLE PERSON’ MEANS A MANAGER OF A LIMITED LIABILITY COMPANY IN WHICH MANAGEMENT IS VESTED IN A MANAGER OR MANAGERS AND A MEMBER OF A LIMITED LIABILITY COMPANY IN WHICH MANAGEMENT IS RESERVED TO THE MEMBERS.”

Section 10.9 When Should You Diversify & Form a New LLC?

One of the most common questions real estate investors ask me is “if I own multiple investment properties, should I put all the properties in one LLC or should I put each property in a separate LLC?” The same issue arises when a company that operates one business has an opportunity to create or acquire another business.

The answer to the question is that usually, every investment property or business should be owned by a separate limited liability company that owns only one property or business and that is not engaged in any other activity. The reason is simple: to maximize asset protection.

Consider the fairy tale of the three little pigs. The three little piggies each owned three rental properties (or substitute three businesses if you like – the concepts are the same) each of which had equity values of $100,000. The first pig owned his properties in his name. The second pig owned all three properties in a single LLC. The third pig formed three LLCs and each property was owned by a separate LLC. By sheer coincidence, the water heater in one of the properties owned by each pig blew up and killed a tenant.

The first pig got sued by the family of the deceased because he owned the rental home in his name. He lost all of his life savings of $1,000,000 when the $2,000,000 judgment exceeded his $1,000,000 insurance policy. The plaintiff was able to have the sheriff seize and sell the first pig’s assets at auctions (including the three properties with $300,000 equity) to collect money to pay the $1,000,000 unpaid judgment. The first pig was not even able to protect $150,000 of equity in his Arizona residence normally provided by the Arizona homestead exemption because he had borrowed all of the equity in his home to get the money to buy the three rental homes.

The second pig did not own any of the properties (his LLC owned the properties) so he was not named as a defendant in the lawsuit. Unfortunately, the second pig lost all of his combined equity of $300,000 in his three properties when the plaintiff got the $2,000,000 judgment that exceeded his insurance coverage. The good news is that although the second pig lost $300,000, his other assets were saved because the plaintiff sued his LLC as the owner of the properties.

When the plaintiff won the $2,000,000 judgment, the third pig lost his equity of $100,000 in the property where the water heater blew up. The plaintiff sued the LLC that owned damaged property and got a $2,000,000 judgment. This plaintiff collected the $1,000,000 of insurance and the $100,000 of equity in the home, but nothing else. The third pig’s $200,000 of equity in his other two LLCs was saved along with all of his personal assets.

The following table illustrates the significantly different economic results experienced by each pig caused only by the pigs’ three levels of LLC diversification:

| Number of LLCs | Economic Loss | |

|---|---|---|

| 1st Pig | 0 | $1,000,000 |

| 2nd Pig | 1 | $300,000 |

| 3rd Pig | 2 | $100,000 |

If they had formed three LLCs to hold their properties, the 1st pig would have protected $1,000,000 and the 2nd pig would have protected $200,000.

To learn more about this important topic read my article called “How Many LLCs Should I Form for My Properties?“